eNewsletters

How to secure your monthly Child Tax Credit payments

Washington, D.C.,

May 15, 2021

Tags:

Tax Reform

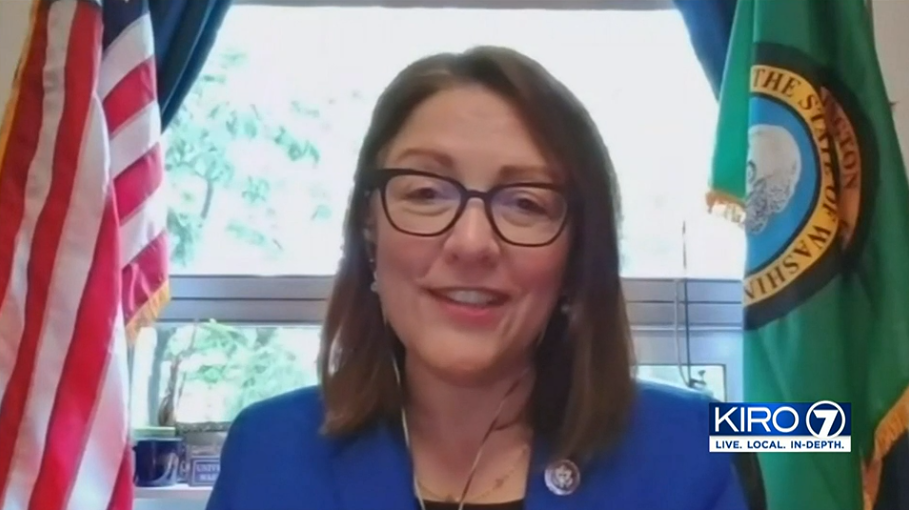

Dear friend, The American Rescue Plan included an important provision I championed that expanded the Child Tax Credit for one year to provide up to $3,000 per child per year and $3,600 for kids under 6 to qualifying lower- and middle-income families. Part of this benefit will be issued monthly starting in July through December. These payments can be used for monthly expenses including paying rent, buying groceries, and affording child care. To make sure your family gets the benefit you’re entitled to, you should file your taxes by May 17. Single filers making under $75,000 and joint filers making under $150,000 a year will receive the full benefit. Child Tax Credit payments will be calculated using your most recent return. Filing will also help ensure that you receive additional tax refunds, like the Earned Income Tax Credit and stimulus rebates. Here’s what I had to say this week about this important provision: If you need assistance filing your taxes, check out these resources available to you: As always, I am here to help you. If you need assistance at this difficult time, please don’t hesitate to leave a message with my Kirkland office at (425) 485-0085. For more updates on what I’m doing for WA-01, you can follow me on social media at the links below. Stay safe and stay healthy, Suzan |